The mortgage amortization table is an essential term that we sometimes don't give all the importance it deserves. Does it sound familiar to you, but you don't really know what it is or how it works? We're going to remedy that right now. The first thing you need to know is that amortizing is equivalent to returning the money in financial jargon.

What is a mortgage amortization table?

If amortizing means repaying, what does the amortization table consist of? Its name suggests that it is a table that summarizes how the mortgage money will be repaid .

Are you thinking that this is done month by month? Indeed, that is how it is done in most mortgages, but the amortization table goes beyond what you pay in each installment. In fact, it is the mortgage payment schedule. It tells you how much you will pay in mortgage installments and also how that money is distributed between the capital to be amortized and the interest.

And this is how the amortization or repayment of mortgage money is actually structured. Now you will understand it better.

How a mortgage repayment works

The mortgage can be repaid in different ways depending on the amortization system used, which is usually the French Amortization System:

• French system: fixed monthly installments are paid, which include part of the loan capital and part of the interest.

• German system: the same amount of capital is amortized in all installments and less interest as time passes.

• American system: the loan capital is amortized in a single amount and the interest is paid in periodic installments.

Depending on whether one amortization method or another has been stipulated, the amortization table will appear in a different way.

In the case of the French method, which is the one we use at Hipotecas.com, with each mortgage payment you return a portion of the capital borrowed and also pay interest to the financial institution for lending you that money.

That is, on the one hand, you allocate a percentage of your money to effectively reduce debt or the principal of the mortgage, which is what is called amortizing capital. And, on the other hand, you use another percentage of that money to pay interest to the financial institution.

The amortization table reflects these percentages and how they evolve over time depending on the term of the mortgage . This evolution will depend on the amortization system of your mortgage. For example, the French amortization system, which is the most common in Spain, concentrates a large part of the interest payment in the first years. This is how it manages to offer constant instalments and that they are not higher at the beginning of the mortgage, which is what happens with the German or constant instalment system.

What is the use of knowing the amortization table?

This document contains very interesting and useful information about your mortgage. The amortization table includes:

• The repayment schedule with the number of months and installments you will pay to repay the mortgage.

• How much you will pay each month . If the mortgage is fixed rate , you will know from the start the monthly amount of the instalment and the distribution between capital and interest. And with a variable rate mortgage? In this case, the amortization table will vary each time the loan is reviewed. The schedule will not change, but the instalment to be paid and the amount of interest and capital that is amortized at each time will.

• The interest you will pay in each installment.

• The capital that you repay or amortize , which is how much your debt or mortgage principal is reduced.

• How much money you have left to pay on your mortgage after each payment, which is the outstanding principal.

With this information, you will be able to make better decisions about your mortgage. For example, you will be able to know when it is best to pay off your mortgage early (usually at the beginning) and how that affects the outstanding principal and interest.

You will also be able to see how the loan stands to decide whether to pay off the mortgage instalment or term.

Ultimately, the amortization table is a summary of how the elements of your mortgage combine to result in the monthly payment you'll pay.

How and where you can consult the amortization table

This table is so important that the financial institution is obliged to show it to you before signing the mortgage . In fact, it is included in the FEIN or European Standardised Information Sheet, which is one of the documents that the institution must give you before signing the loan.

After taking out the mortgage, you can check it whenever you want. Depending on the bank, you will have to ask for it or you can access it through online banking. In any case, whenever you ask for this information, they should give it to you, although some banks may charge you for doing so.

Amortization table example

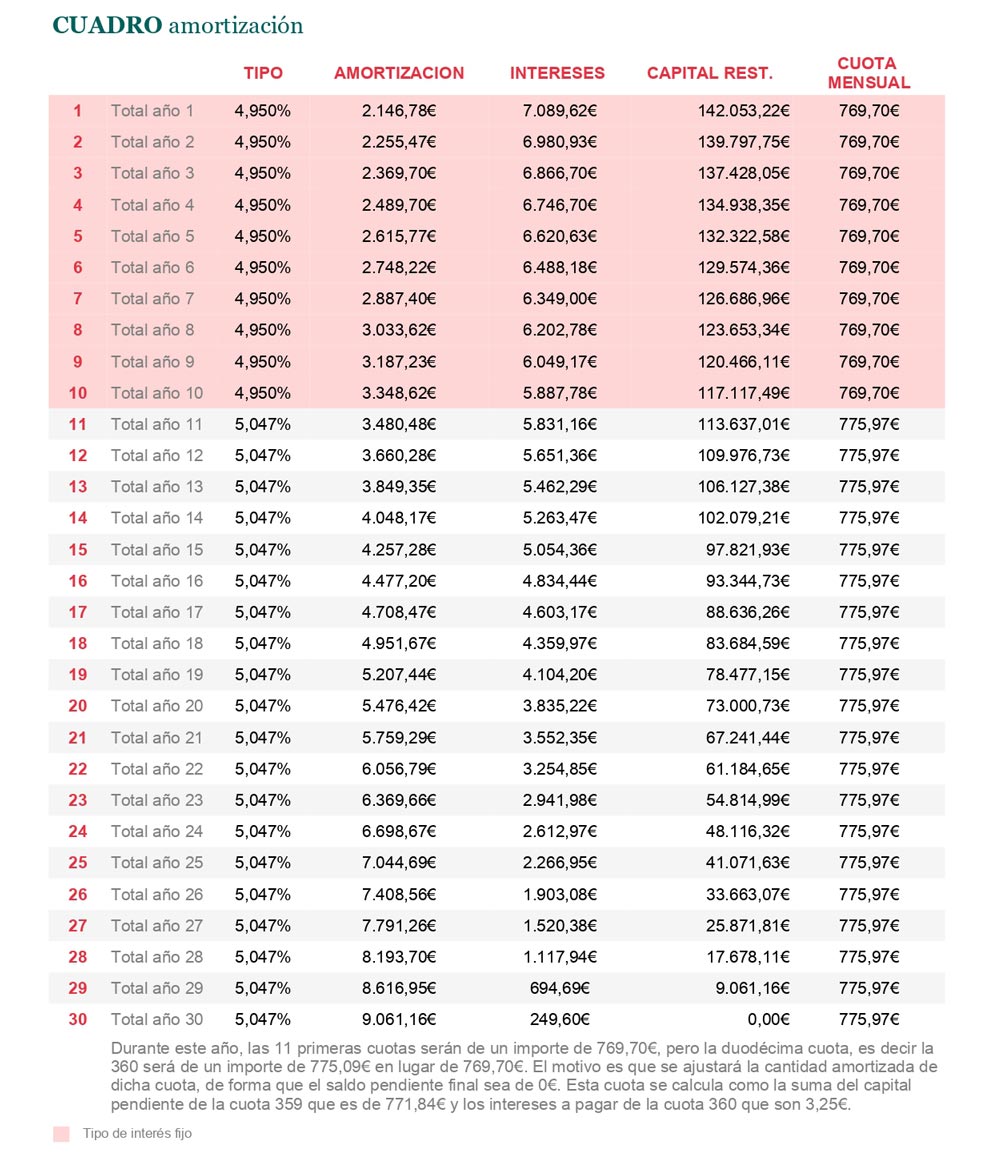

Finally, there is nothing like a practical example of what an amortization table would look like for a 30-year mortgage for an amount of 130,000 euros and a mixed rate.