With a mortgage, it matters how much you pay, how you pay it and how the interest is calculated. The reason? There are different systems and types of amortization , and not all of them work the same.

Knowing which one you have or which one is offered to you can make all the difference.

What are the types of amortization?

Amortization rates or systems determine the way in which the mortgage money will be repaid. They define the monthly loan payment , the interest rate result, the capital loaned and the repayment period.

Amortization rates or systems determine the way in which the mortgage money will be repaid.

Depending on how the system is structured, the mortgage payments will be constant, increasing or decreasing. In other words, you will always pay the same payment on a fixed-rate mortgage (variable-rate mortgages always change) or the payment will change as you repay the money.

The loan amortization table, which every institution must give you before signing your mortgage, will allow you to see how the money is repaid and how your mortgage payment will evolve depending on the type of amortization you have.

The French system of amortization

The French amortization system or constant installment system is the most common in Spain and the one included by default in most mortgages. It is characterized by the fact that the mortgage installments do not change throughout the entire life of the loan . The exception is variable rate mortgages , where the installment is adjusted when it is revised, usually on a semi-annual or annual basis, but this does not imply a change in the calculation basis. With this system, the interest on each installment is calculated according to the capital pending amortization. As a result, the first years will be those in which the interest payments are concentrated. The following image summarizes how it works:

The German amortization system

In contrast to the French system is the German amortization system or decreasing installment system.

This system amortises a constant portion of the principal over the life of the loan and calculates interest based on the remaining principal. The result is that the instalments at the beginning of the loan will be higher because the outstanding principal is higher and will become smaller until at the end they are practically zero.

This would be its graphic representation:

The main advantage of this system is that the capital is paid off more quickly. This makes it more effective if you plan to pay off your mortgage in advance.

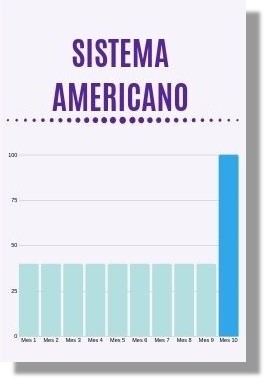

The American system of amortization

Finally, there is the American amortization system, which uses a type of amortization at maturity. In a very brief way, you leave the payment of the outstanding capital for the end.

Using the American amortization system , you pay the interest on your mortgage each time, without paying off the capital. The capital, that is, the money you have borrowed for the mortgage, is returned in the last installment.

This type of amortization is designed to encourage savings. In other words, so that you can save and usually invest the money that you stop paying in capital so that you can face the final payment, which will be very large.

However, compared to the pure American amortization type, variants have been created where some capital is returned in each monthly payment.

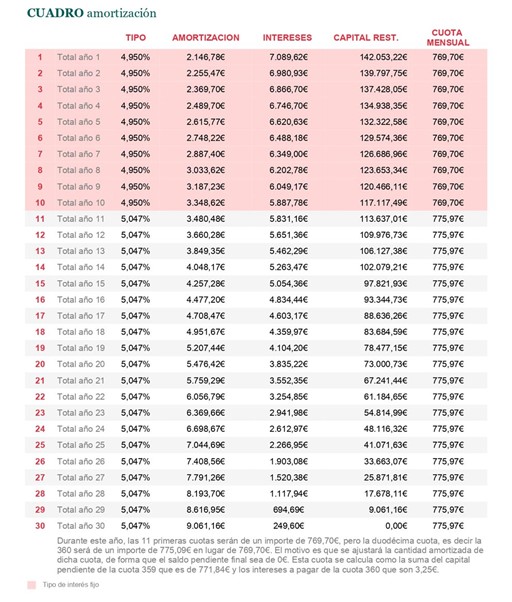

How to interpret the amortization table?

The mortgage amortization table is one of the most useful tools for understanding how different types of mortgage amortization work.

Essentially, this table summarises how much of the monthly payment is used to pay interest and how much is actually used to pay off the principal, i.e. to pay off the debt. Depending on the amortisation system, the amount will vary, as will the payment.

Here you can see an example of the amortization table for a 30-year mortgage for 130,000 euros at a mixed rate using the French amortization system, the most common in Spain.

Which is better for your mortgage?

Mortgages in Spain mostly use the French amortization system. This is the one you will find by default. If you want a different one, you will have to request it from the entity.

The advantage of the French system is clear: the financial effort remains stable throughout the life of the loan. In other words, the payments are constant and also lower than those of the German system in the first years, which is when you have less money, having used your savings to pay the down payment on the house.

Mortgages in Spain mostly use the French amortization system

That's the big advantage. The downside, as you've seen, is that you'll pay most of the interest during the first few years without paying off too much principal. This can result in you paying more interest over the entire life of the loan.

However, a system like the German one, with such high initial installments, is not affordable for everyone, since when you are younger you tend to earn less money and have fewer savings.

Finally, the American system imposes a saving discipline that not everyone can or wants to follow. Imagine if various unforeseen events arise and you cannot put together the sum you need at the end of the loan. You will have paid all the interest and you could still lose the house.

That is why the French system is the most common because, despite its weaknesses, it is the most accessible to everyone.