Inflation has become one of the financial trends of 2021 and promises to continue to be so in 2022. The CPI closed December 2021 at 6.7% and Funcas assures that it will remain around 5% during the first part of the year and 3.7% on average for the whole of 2022. In short, the cost of living and the price level will continue to rise.

Housing is not immune to this price increase, especially since it is accompanied by a rise in the price of raw materials, which affects construction materials in the case of new homes.

How housing prices behave in response to inflation

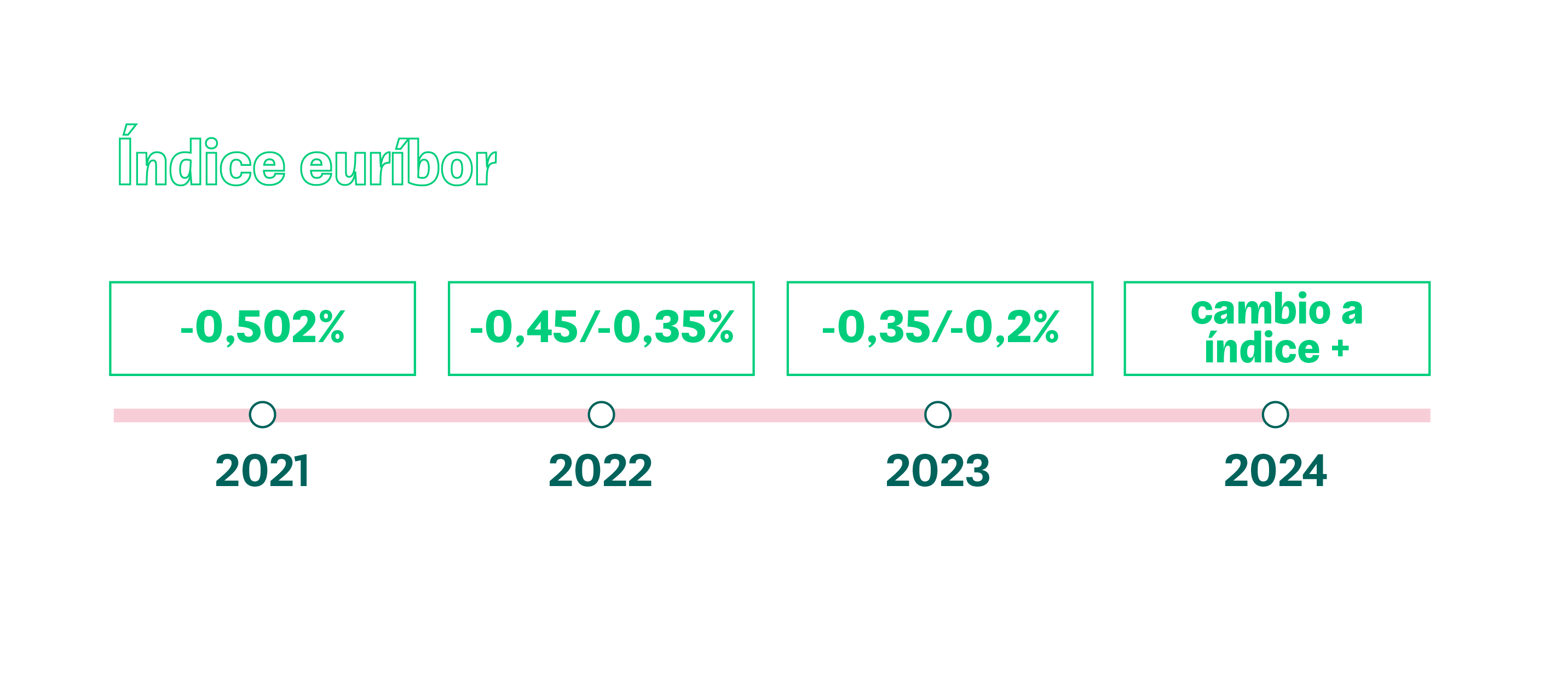

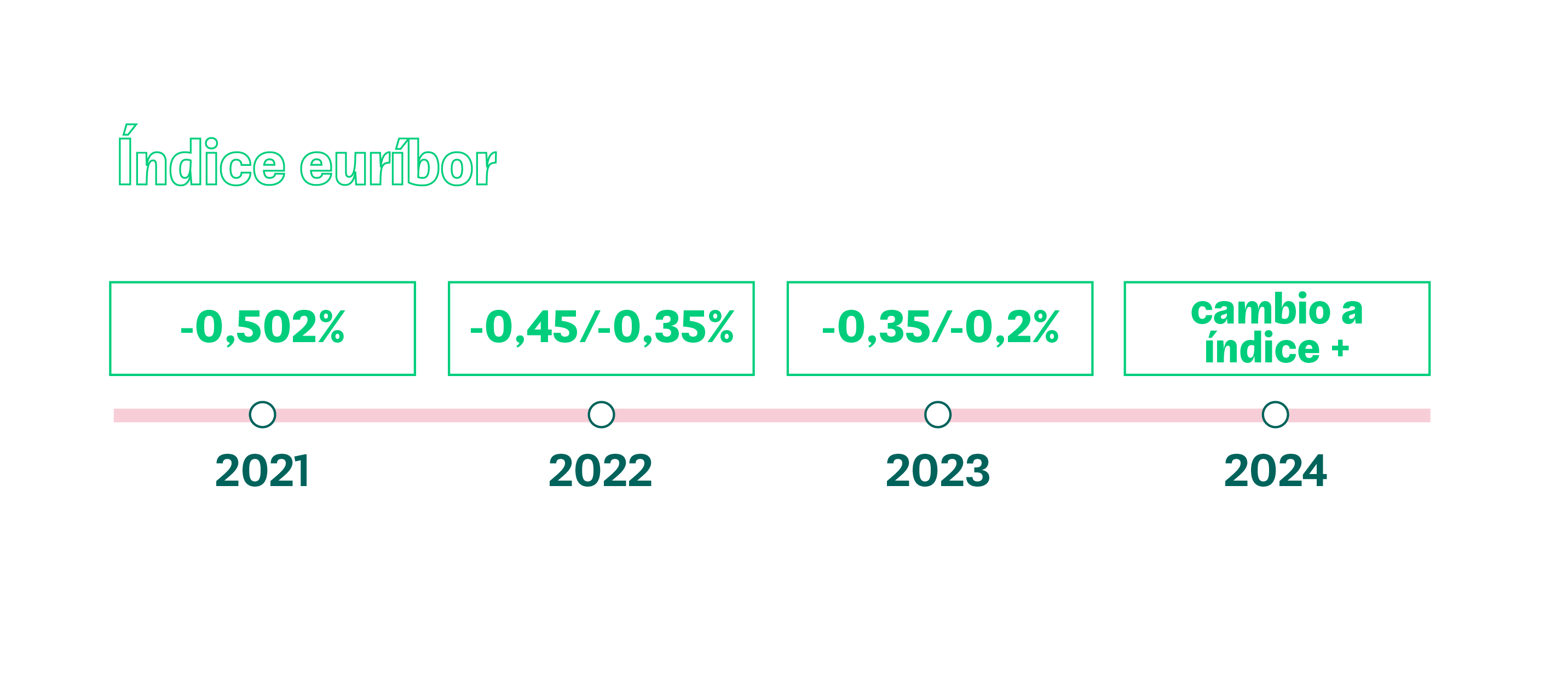

Inflation can be affected by a direct rise in interest rates, as this is the mechanism that central banks, such as the ECB, usually use to combat inflation. Consequently, a rate hike could cool down the real estate market, as half of all housing transactions are made with mortgages.

Inflation also directly affects construction costs, both in terms of raw materials and energy, which could lead to an increase in the price of new housing, which accounts for 1 in every 6 sales.

“Although high inflation and uncertainty about the evolution of interest rates may cool demand for housing, we at the UCI Group do not believe that this will significantly slow down the development of the real estate market throughout the year,” explains José Manuel Fernández, deputy general manager of UCI (Unión de Créditos Inmobiliarios).

Is it a good refuge from rising prices in 2022?

Experts are clear: yes, investing in housing is a good option to combat current inflation, according to sources consulted by Cinco Días iii and El Economista.

There are several reasons behind this statement. On the one hand, Covid-19 halted many sales transactions in 2020 and increased household savings to multi-year highs.

This has already translated into an increase in the number of home sales in 2021 to 2008 levels. “The number of home sales in Spain is showing very positive data, with 35% more transactions than last year and a tendency towards stability after the toughest months of the pandemic and a period of correction,” Fernández certifies.

The trend is expected to continue in 2022, as many operations could not be closed last year due to lack of supply. Specifically, “right now we can talk about stability and growth of around 5-10%” according to the UCI expert.

Fernández explains that “during periods of inflation, housing is one of the few assets that registers high levels of interest from investors and buyers. Real estate is always seen as a safe investment asset, even more so in a country like Spain.” The UCI expert adds that “property has been recovering its value as a safe haven asset during these months, especially due to the recovery of tourism and the growing demand for housing by foreigners. To which we must add the situation of low interest rates, which allows access to advantageous mortgage solutions for investors and owners.”

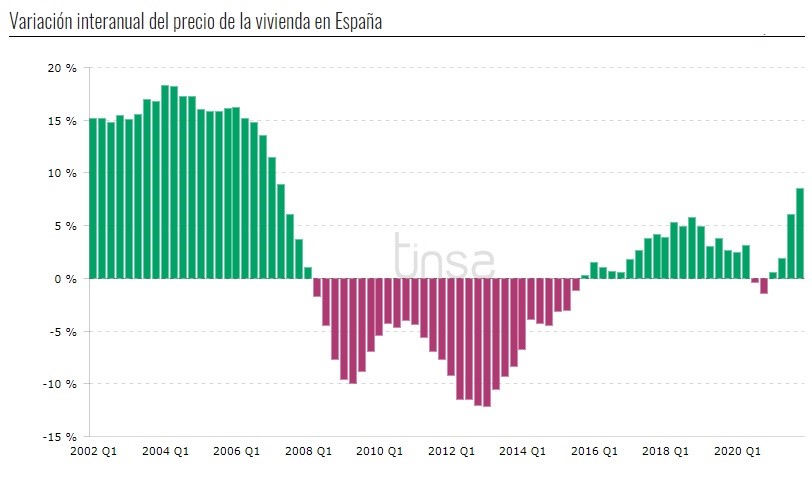

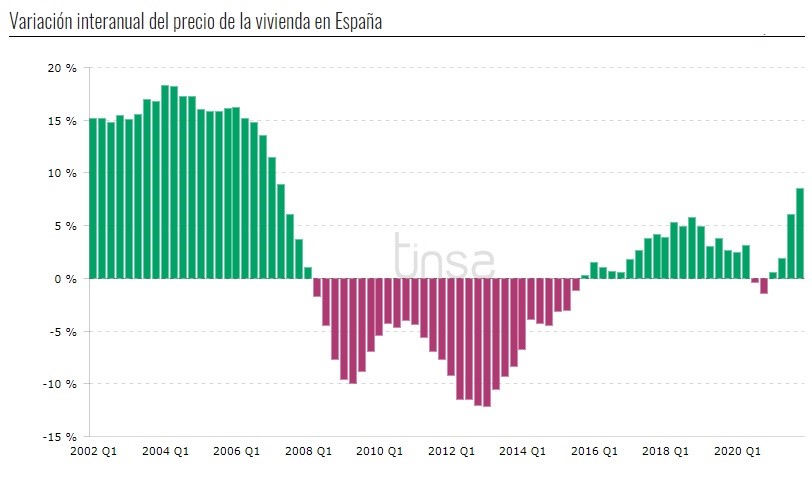

Along the same lines, Pisos.com pointed out that housing could be considered an investment to protect against inflation if the annual price level exceeded or approached the inflation figure. The CPI closed December at 6.7% and the price of housing rose 8.5% year-on-year in the last quarter of the year according to Tinsa data.

The appraisal agency points to the residential sector as an attractive investment in the absence of more profitable alternatives with the same level of risk. Products such as deposits currently yield barely 0.5% at best, and the same is true of sovereign debt.

What is the profitability of housing?

Compared to the meager benefits offered by traditionally conservative products, the profitability of investing in housing is much greater.

A study by Idealista estimates the profitability of investment in housing at 6.9% throughout 2021, while the latest data from the Bank of Spain x (BdE) puts it at 7.9% for the third quarter of last year.

Of this percentage, 3.7 points would be directly related to rent. The rest of the benefit would be the revaluation of the property itself.

76% of Spaniards believe that buying a house is the best way to invest for the future and the truth is that it can be a very good investment due to its ability to generate recurring income.

The average profitability of renting a home over the last 26 years has been 5% compared to 8% for the Ibex 35xii, a substantial difference that has a specific toll: the ups and downs in the stock market that the rental market does not experience.

To understand this better, imagine that you have invested 100,000 euros in the stock market and the market falls by 5%. You would have 5,000 euros less. The same does not happen with investment in housing. The price of your house may fall, but it will continue to generate rent month after month. In addition, you will not be dependent on the value of the house as you would be on the price of a share.

These two differences make investing in housing and buying to let particularly attractive, especially now in an environment of low interest rates and cheap mortgages. In fact, you can even find special mortgages for home renovations, something you will normally need to do if you plan to rent.

How housing prices behave in response to inflation

Inflation can be affected by a direct rise in interest rates, as this is the mechanism that central banks, such as the ECB, usually use to combat inflation. Consequently, a rate hike could cool down the real estate market, as half of all housing transactions are made with mortgages.

Inflation also directly affects construction costs, both in terms of raw materials and energy, which could lead to an increase in the price of new housing, which accounts for 1 in every 6 sales.

“Although high inflation and uncertainty about the evolution of interest rates may cool demand for housing, we at the UCI Group do not believe that this will significantly slow down the development of the real estate market throughout the year,” explains José Manuel Fernández, deputy general manager of UCI (Unión de Créditos Inmobiliarios).

Is it a good refuge from rising prices in 2022?

Experts are clear: yes, investing in housing is a good option to combat current inflation, according to sources consulted by Cinco Días iii and El Economista.

There are several reasons behind this statement. On the one hand, Covid-19 halted many sales transactions in 2020 and increased household savings to multi-year highs.

This has already translated into an increase in the number of home sales in 2021 to 2008 levels. “The number of home sales in Spain is showing very positive data, with 35% more transactions than last year and a tendency towards stability after the toughest months of the pandemic and a period of correction,” Fernández certifies.

The trend is expected to continue in 2022, as many operations could not be closed last year due to lack of supply. Specifically, “right now we can talk about stability and growth of around 5-10%” according to the UCI expert.

Fernández explains that “during periods of inflation, housing is one of the few assets that registers high levels of interest from investors and buyers. Real estate is always seen as a safe investment asset, even more so in a country like Spain.” The UCI expert adds that “property has been recovering its value as a safe haven asset during these months, especially due to the recovery of tourism and the growing demand for housing by foreigners. To which we must add the situation of low interest rates, which allows access to advantageous mortgage solutions for investors and owners.”

Along the same lines, Pisos.com pointed out that housing could be considered an investment to protect against inflation if the annual price level exceeded or approached the inflation figure. The CPI closed December at 6.7% and the price of housing rose 8.5% year-on-year in the last quarter of the year according to Tinsa data.

The appraisal agency points to the residential sector as an attractive investment in the absence of more profitable alternatives with the same level of risk. Products such as deposits currently yield barely 0.5% at best, and the same is true of sovereign debt.

What is the profitability of housing?

Compared to the meager benefits offered by traditionally conservative products, the profitability of investing in housing is much greater.

A study by Idealista estimates the profitability of investment in housing at 6.9% throughout 2021, while the latest data from the Bank of Spain x (BdE) puts it at 7.9% for the third quarter of last year.

Of this percentage, 3.7 points would be directly related to rent. The rest of the benefit would be the revaluation of the property itself.

76% of Spaniards believe that buying a house is the best way to invest for the future and the truth is that it can be a very good investment due to its ability to generate recurring income.

The average profitability of renting a home over the last 26 years has been 5% compared to 8% for the Ibex 35xii, a substantial difference that has a specific toll: the ups and downs in the stock market that the rental market does not experience.

To understand this better, imagine that you have invested 100,000 euros in the stock market and the market falls by 5%. You would have 5,000 euros less. The same does not happen with investment in housing. The price of your house may fall, but it will continue to generate rent month after month. In addition, you will not be dependent on the value of the house as you would be on the price of a share.

These two differences make investing in housing and buying to let particularly attractive, especially now in an environment of low interest rates and cheap mortgages. In fact, you can even find special mortgages for home renovations, something you will normally need to do if you plan to rent.