When renowned investor Warren Buffet was asked about the key to his success , he replied that it was due to a combination of factors: “living in America, some lucky genes and compound interest.”

Since you can't change your DNA and you may not want to move to another country either, at Hipotecas.com we'll tell you how to take advantage of compound interest.

What is compound interest?

According to the Bank of Spain , compound interest is “the financial process in which the interest of each period is added to the initial capital to produce new interest .”

That is to say, the returns that a deposit or fixed-term deposit leaves you are added to your initial contribution, which means that in the following period - whether daily, monthly, half-yearly, yearly, etc. - the interest obtained is greater, creating a kind of snowball that makes compound interest so highly valued in the financial sector.

Thus, unlike simple interest, in which the interest generated by the investment is not incorporated into the productive capital, but is withdrawn at the end of each period, compound interest allows for exponential economic benefits. Specifically, thanks to this financial formula, you can achieve greater savings without needing to make new contributions to the principal, a difference that also grows with each maturity. Therefore, it is ideal for long-term investments .

How is compound interest calculated?

To obtain the profitability that a deposit or savings account with compound interest will produce, the following formula is used:

CF 1 = C 1 (1+r) n

( CF 1 is the final capital or future capital / C 1 is the initial capital / r is the interest rate expressed in decimals / n is the duration of the investment expressed in number of liquidations)

But let's see how it works with an example. Imagine that you are going to invest 10,000 euros for 5 years in a financial product that offers you a return of 10% per year. What differences would you achieve if compound interest were applied instead of simple interest?

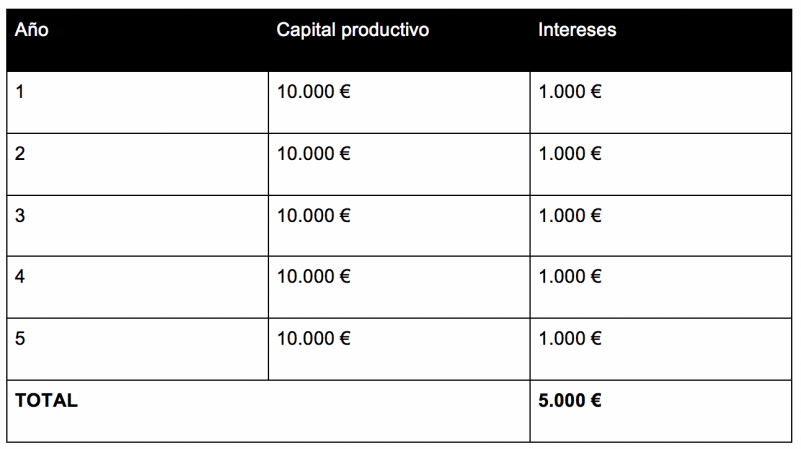

With simple interest, you would earn a profit of 1,000 euros on those 10,000 euros each year , which translates, at the end of the term, into 5,000 euros, plus the 10,000 euros of principal. That is:

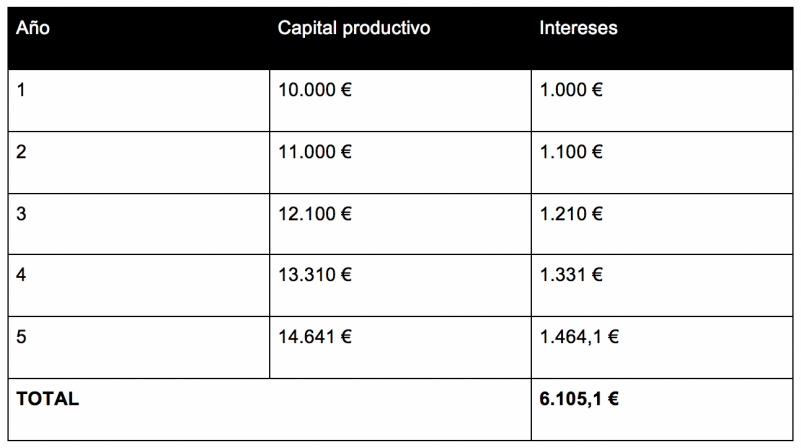

What happens when compound interest is applied to this same transaction?

CF 1 = 10,000 (1+0.10) 5

In this case, the interest that the deposit will yield will reach 6,105.1 euros, plus the 10,000 euros of initial capital, that is, in just five years you will get 1,105.1 euros more profit than with an investment with simple interest.

Of course, you will have to subtract inflation and applicable taxes on capital gains from these benefits, but this is required in both cases, so the advantage of compound interest over simple interest is maintained.