What is debt consolidation and how does it work without a mortgage?

Debt consolidation consists of consolidating all outstanding debts into a single loan and paying a single monthly payment that concentrates all payments into one. With this financial instrument, you can save some money each month because, as a general rule, it will be cheaper to pay a single payment than to pay several monthly payments corresponding to different loans or credits.

It is also possible to obtain a more affordable interest rate, especially for those corresponding to credit cards. However, this instrument generally uses extended repayment periods to make it easier for the client to deal with their debts more comfortably.

In order to consolidate all debts, the entities may require us to provide collateral, such as owning a home. However, it is now also possible to consolidate all payment commitments into a single loan without owning a home, i.e. to consolidate debts without a mortgage.

* Source: Thousand Quick Credits

What guarantees will they then ask you for in order to consolidate your debts?

Logically, the entity you are negotiating with needs guarantees, so it may ask you for any of the following elements as support for the operation:

Personal guarantees

You will have to prove that you have assets that guarantee that you can repay the money borrowed and that are equivalent to the amount of the reunification.

Available balance

Debt consolidation can also be authorized as long as you have a balance in current accounts, deposits, pension plans or investment products that can cover the outstanding debt.

Guarantees

In an extreme case, the entity could require you to present a guarantor with sufficient assets who could respond for payments in the event that you were to declare bankruptcy.

If all your payment commitments are with the same bank, it will be easier to negotiate debt consolidation. However, if your loans belong to different entities, the negotiation and the consolidation operation will not be so simple. In any case, it would be the financial institution that manages the largest loan that would have to approve the consolidation of your debts.

As with other financial transactions, the bank will require you to deposit your salary, if you do not have it already, to give the green light to the reunification.

What happens if we consolidate the debts into one? ![]()

![]()

![]()

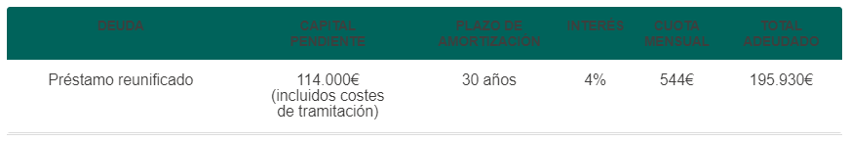

As we can see, thanks to the operation, we went from paying 1,007 euros per month to a monthly payment of 544 euros. On the other hand, before consolidating loans, we would have paid off all the debts in 20 years, whereas, after the procedure, the period is extended to 30, with the appropriate interest, so that in the end we will pay 57,333 euros more for all the credits.

Therefore, consolidating loans has both advantages and disadvantages, so choosing this option will depend on each person's financial situation.

In this regard, it is very important to analyze family circumstances and study the conditions and costs involved in consolidating loans into one.

What expenses does debt consolidation entail?

Debt consolidation not only involves grouping debts, but also involves several additional expenses, such as:

• Cancellation and opening fees : When cancelling existing debts and creating a new one.

• Mortgage costs : If the consolidation includes a mortgage, associated costs, such as appraisal and notary fees, apply.

• Cost of service : If you use a mediation company, the cost of their services is also included.

How to carry out reunification?

If, after assessing your personal situation, you decide to consolidate your loans, you should know that this process is carried out by financial institutions, private equity companies or financial intermediaries . If all or most of your loans have been contracted with the same entity, it is advisable to go to this operator to request debt consolidation. If each loan is from different entities, there are intermediary companies that also offer this financial product.

In all cases, the entity will proceed to assess the particular case, deciding whether or not to approve the operation and, if applicable, under what payment conditions . What do they usually take into account when granting debt consolidation?

- That all existing loans are grouped together , that is, we will not be able to consolidate some credits and not others.

- That the outstanding capital, in the case of mortgage loans, does not exceed 80% of the value of the property.

- That we meet the usual requirements for granting a loan , such as stable and demonstrable monthly income, not being included in a list of defaulters and presenting a guarantor to support us.

After negotiating the terms with each company, comparing the different final proposals and choosing the most advantageous offer, the loan consolidation will be carried out through the cancellation of all existing loans and the creation of a new one under the agreed conditions .